When Bubbles Build Civilization

Look, I'm going to save you about forty hours of scrolling through AI takes on LinkedIn.

Half the posts are tech bros posting screenshots of their latest automation workflow like they've discovered fire.

The other half are doomsayers screaming BUBBLE in all caps, waiting for the crash so they can feel smart.

Here's the thing: they're both right. And they're both completely missing the point.

The entire debate is built on a false choice. Bubble or revolution. Hype or substance. You have to pick a side.

No, you don't.

Every civilization-grade technology shift in the past 500 years has been both a speculative bubble and a genuine transformation. At the same time. The bubble doesn't cancel out the revolution. The bubble FUNDS the revolution.

This isn't some cute both-sides-ism. It's just history. And if you don't understand this pattern, you're going to make really stupid decisions about AI in your organization.

So let's talk about what actually happens when bubbles build civilizations.

The First Content Crash (Venice, 1473)

The printing press was invented around 1450. Took about twenty years to reach Venice. And when it did, investors lost their goddamn minds.

Within four years, the market was flooded with printers churning out anything they could get their hands on. Mostly garbage Latin translations and religious texts nobody asked for.

Then it crashed. Hard. Printers went bankrupt everywhere.

Sound familiar? Swap "printers" for "AI startups" and "Latin bibles" for "AI-generated SEO slop" and you've got 2025.

But here's what the bubble skeptics don't tell you.

Out of that wreckage came a guy named Aldus Manutius (founder of Aldine Press 1494).

While everyone else was crying about the crash, he looked around and asked a different question.

Not "how do I print more books faster."

But "what do people actually want?"

His answers: Pocket-sized books you could carry around. Denser type that used less paper. Greek classics that scholars would actually pay for.

Faster. Cheaper. Better. All three at once.

Manutius didn't survive because he avoided the bubble. He survived because he understood what the bubble had built: cheap printing infrastructure, trained workers, distribution networks. The speculation funded the installation. The crash cleared out the idiots. What remained was capability waiting to be harvested.

The printing press didn't fail. The speculators did.

That distinction matters.

The Crash That Built the Car Industry

In the 1890s, everyone went insane for bicycles. Massive stock bubble. Bicycle patent companies everywhere. It was the AI of its day.

Then it popped in 1897. Seventy-five percent of bicycle companies went bankrupt.

But the interesting point is that the bubble had funded the development of precision ball bearings, pneumatic tires, differential gears, and stamped steel tubing. This was hard, expensive R&D that no rational investor would have funded on its own. The payoffs were too uncertain. The timelines too long.

But wrap it in a speculative mania? Suddenly money floods in from everywhere.

A decade later, Henry Ford wanted to build the Model T. He didn't have to invent any of this stuff. He just picked it up (perfected and cheap) from the bicycle bust.

The speculators lost everything. Ford built an empire on their wreckage.

The failed bicycle bubble literally built the automotive age.

This is what the binary thinkers can't see. The speculation and the transformation aren't separate things. The speculation funds the transformation. The crash clears the noise. What survives is infrastructure that wouldn't exist without the mania.

Why This Takes Way Longer Than Anyone Wants

Stanford economist Paul David studied something weird about electricity. Factories had access to electric power in the 1880s. But productivity gains didn't show up until the 1920s.

Forty years.

Why? Because factories were designed for steam power. One giant engine driving shafts and belts through the whole building. You couldn't just swap in an electric motor and expect magic.

Real gains required tearing the whole thing apart. New layouts. Distributed motors. Different workflows. Retrained workers. This took decades.

And during those decades? Companies investing in electrification looked like idiots. Productivity actually dropped during the transition. Competitors who stuck with steam seemed smarter.

Right up until they didn't.

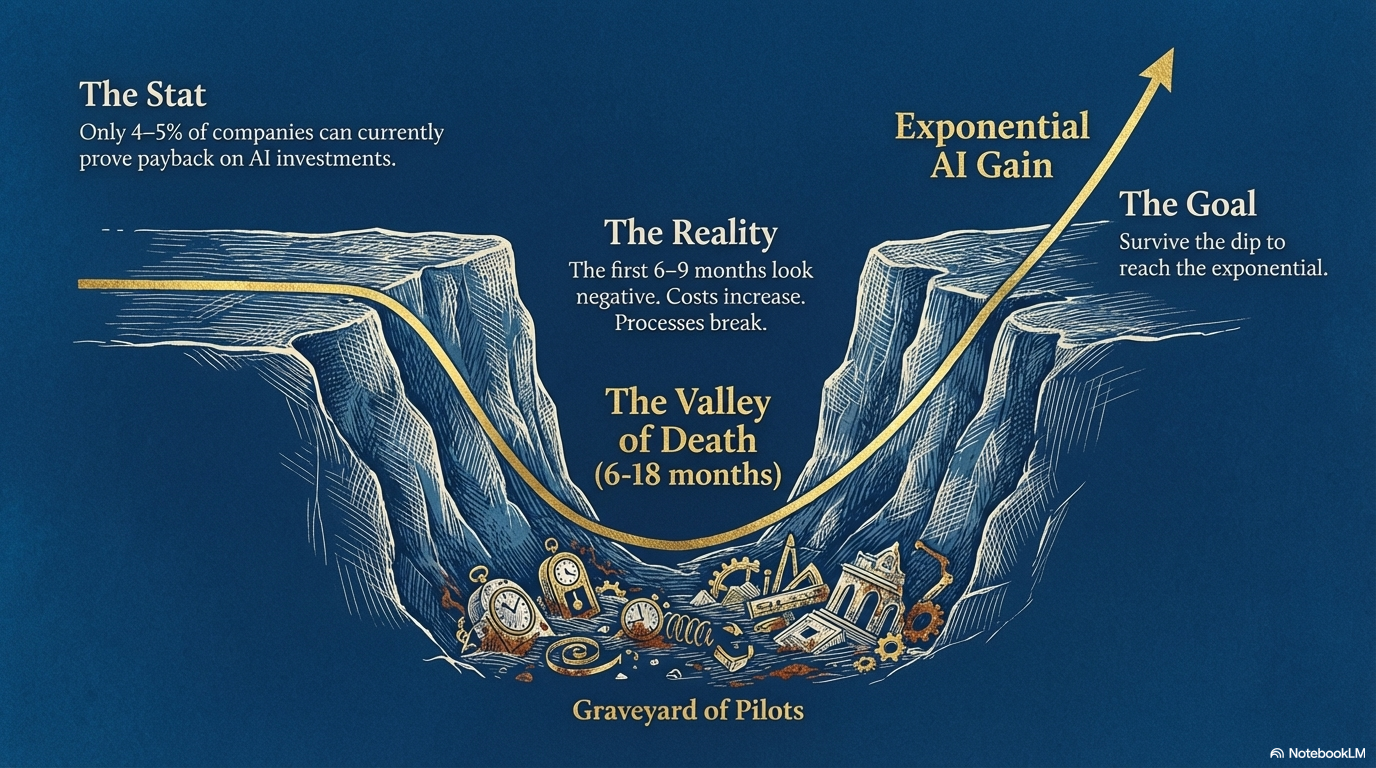

Erik Brynjolfsson calls this the "Productivity J-Curve"

You invest, performance dips, everyone panics, then - if you stick with it - the curve turns upward.

Most companies bail during the dip. They pay the costs of transformation and never reach the gains.

The NASDAQ peaked in March 2000. Didn't recover until 2015. Fifteen years. But all that fiber optic cable laid during the dot-com mania? Still in the ground. Became the cheap bandwidth that enabled YouTube, Netflix, and everything else.

The timeline is longer than anyone wants to admit. The infrastructure persists anyway.

So What's Actually Going On Here?

Let's step back.

Every major infrastructure shift requires massive upfront capital with uncertain, long-delayed payoffs. Rational investors don't fund this. The returns are too speculative. The timelines too long. The beneficiaries too diffuse.

But speculation will fund it.

Wrap the infrastructure in a mania and money pours in from people expecting to get rich.

Most of them won't. But the rails get built. The cables get laid. The printing presses get deployed.

The bubble is the funding mechanism.

This isn't a bug. It's how societies build infrastructure that wouldn't exist otherwise. Speculators think they're getting rich. They're actually subsidizing civilization.

We've done this with canals, railways, electricity, automobiles, and the internet. We're doing it again with AI.

The bubble will probably burst. Some people will lose a lot of money. The infrastructure will still be there.

The Question You Should Actually Be Asking

Here's where most people screw this up. They treat "the AI bubble" as one thing.

It's not.

Cambridge economist Carlota Perez spent twenty years studying every major technological revolution since 1771. Same pattern every time: speculation runs wild, infrastructure gets built, crash happens, then society actually figures out how to use the stuff. The bubble funds the infrastructure. The crash kills the speculators. The infrastructure remains.

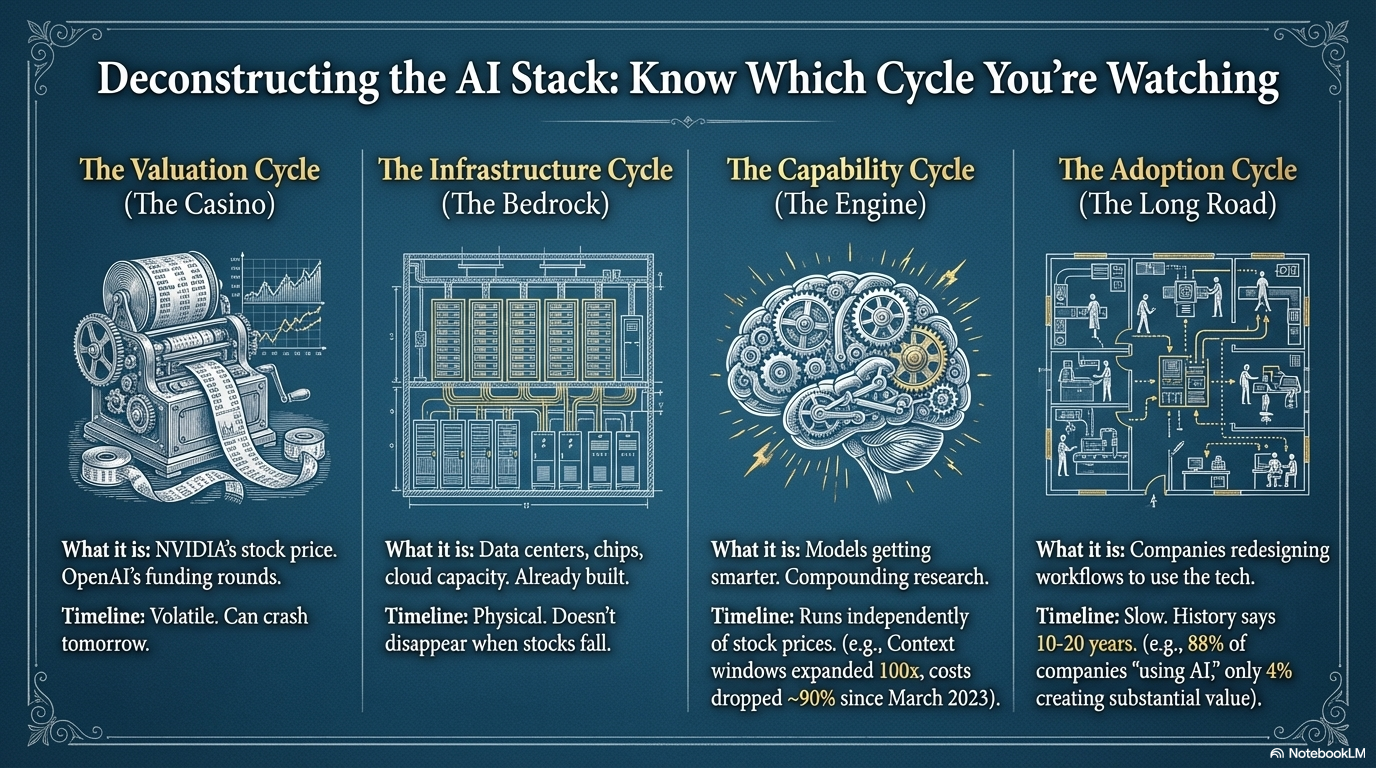

But AI has four separate cycles running simultaneously, each on its own timeline:

These cycles can diverge dramatically.

The Valuation Cycle can crash while Infrastructure is already locked in.

Capabilities can keep accelerating while Adoption crawls.

You can be bearish on the Valuation Cycle and bullish on the other three. That's probably the right position.

When someone screams "BUBBLE!" at you, ask them: which cycle?

Because conflating them is how you end up making dumb decisions.

What This Actually Means For You

You're not a speculator betting on NVIDIA stock. You're a business leader who's going to inherit whatever infrastructure this mania builds - just like Ford inherited the bicycle industry's manufacturing techniques.

So stop asking "is AI a bubble?"

Start asking "what is this bubble building that I'll get to use for cheap in five years?"

Stop asking "should we invest in AI?"

Start asking "what will we wish we'd built when the transformation matures?"

Your job isn't to fund the bubble. Your job is to be ready when it pops.

Here's what that looks like:

The Point

The bubble will burst. Valuations will correct. Speculators will lose money. Headlines will declare AI over.

The infrastructure will still be there. The capabilities will keep improving. The adoption cycle will keep grinding forward for the next twenty years.

The Venetian printers went bankrupt; the printing press changed civilization. The bicycle companies collapsed; the automobile age emerged. The dot-com crash destroyed trillions in wealth; we're more online than ever.

Bubble or revolution is the wrong question. The answer is yes, both, always has been.

The right question is what you're building while everyone else argues about it.

That's the work we do at GRAIL: helping leaders build organizations that capture value from whatever this mania leaves behind.

Not automation that plateaus.

Augmentation that compounds.

The bubble will do what bubbles do. Be ready for what comes after.